Quick Guide

Introduction

The forex market presents abundant options for making money and achieving both your trading and financial objectives. Because of the uncertainty they provide, they can also be extremely painful at the same time. To succeed as a forex trader, you need both knowledge and experience. And it only happened when you start trading with real account. Even if you lack experience, you can still make excellent and worthwhile selections to seize the opportunity. All you require is a best forex signals provider with a solid reputation for being trustworthy, verified, and reliable.

In essence, a best forex signals provider or US30 signal provider aids all types of traders in identifying the open positions at a particular price and at the appropriate moment. These platforms handle all the labor-intensive tasks, so all you have to do is enter a position to make money. Having said that, there are a vast number of forex signal providers or Indices signal Providers on the market, making it difficult to decide which the best choice is. For that reason, we have created this post, which includes the top signal providers or you can US30 signal provider for forex trading in 2022 with a high win rate.

So let’s get started without further ado.

How do Forex signals work?

It’s critical to comprehend what forex signals or Us30 signals are before revealing the best forex signals provider. It’s safe to claim that the trade advice provided by the forex trading signals assist you with the following inquiries:

- Which currency pair or indices or commodities thought to be traded?

- Which currency pair or indices should you buy or sell?

- When should you start selling?

- What kind of profit can be desired?

It’s crucial to keep in mind that you may either follow these signals just as they are or you can incorporate them into a thorough study to enhance your entire trading approach. In either case, the forex signals give you the chance to have a deeper comprehension of the currency market for a more satisfying trading experience.

Considerations for Forex Signals Provider

Before selecting a forex signal Provider, there are a few key considerations you should make. You’ll not only be able to make the greatest choices, but you’ll also be able to accomplish your trading and financial objectives in the shortest amount of time. Here are a few of the most crucial elements that will help you select the best forex signals provider i.e. US30 signals, Nasdaq Signals , Ger30 Signals etc.

So we Recommend Forex buzz

Best US30 signals Providers in the world.

You can Check result here: https://www.instagram.com/theforexbuzz/

Signal provider’s prior experience

If you’re a seasonal trader, you probably already know how difficult it can be to maintain a steady profit from your forex trading. In addition to your own experience, the provider’s experience is also important. Therefore, age and experience are the first and most crucial factors to consider when selecting a forex signal service. It will enable you to comprehend the provider’s constancy over time.

Superior Quality to Quantity

When searching for forex signal providers, one of the most frequently asked questions is “How many signals will the service supply daily/weekly?” The answer is unquestionably yes, and you can pick the provider who gives the signals at the frequency that suits your requirements. But it’s also crucial to remember that increasing your trading volume doesn’t automatically translate into higher earnings. Both the quantity and calibre of trading signals might change. Instead of leaping into the market and staying there all the time, think about finding the right position.

Automation

You may receive trades via SMS or email, depending on your forex signal provider. However, some signal providers completely automate the entire procedure. Some providers of forex trading signals also let you automatically duplicate other traders’ real-time trades.

Setting your trade parameters is all that’s required; the signals will take care of the rest. Automating the deal is not necessarily a superior choice, though. Actually, it just comes down to personal preference, but we advise you to look into all of your possibilities.

Pros and Cons of Trading Using Forex Signals

Trading forex signals /us30 signals has several drawbacks in addition to its benefits that you should be aware of. It will enable you to guarantee the effectiveness of your forex signal trading.

👍Pros

• Time Savings: Forex signals allow you to save a lot of time. This function is useful, especially for those who want to get involved in trading while maintaining a full-time professional position. A trading signal provider will keep track of all the prospective trading chances for you, so you don’t have to.

• Minimize Risk: If you choose a reputable forex signal provider, forex trading signals can help you reduce market risk. This is so that you have opportunities with a good possibility of success, which these platforms give you.

• Enhance Learning: There will be several possibilities for you to learn about the currency markets. By knowing about various market elements, you can investigate the reasons behind the generation of particular trading forex signals or US30 signal.

• Abundantly available: There are many forex trading signal providers who supply trading signals.

👎Cons

• Scams: There are numerous forex signal providers on the market as a result of the effectiveness of forex trading signals. The vast quantity also indicates that there are some fake scammers out there.

• Unreliable: Not all of the forex signal suppliers on the market are trustworthy. It’s crucial to make sure that the company you select must supply worthwhile signals that can genuinely assist you in making money.

• Price: As was already indicated, there are absolutely free forex signal providers, but the majority of them fall short in terms of usefulness. On the other side, paid subscriptions are effective, but they can be expensive, especially for new traders.

Primary Forex Signal Types

Prior to recently, the trader had few options. Either trade independently or entrust the money manager with their assets. However, the introduction of forex signals modified the rules of the game, giving traders a wider range of options. The majority of the time, Indices signals are based on changes in price or an indicator. Find out more by reading on.

Signals Based on Indicators

There are a few primary categories of indicators-based signals, which are as follows:

RSI Indicator

On the chart, relative strength index, or RSI, is one of the leading indicators and often appears before price occurrences. It is a momentum oscillator that determines both the pace and the variation of price movements. It varies between 0 and 100. The RSI is typically regarded as oversold when it falls below 30 and overbought when it rises beyond 70. In order to determine the overall trend, failed swings and divergence are used to construct the RSI signal.

Moving average signals (MA)

The daily volatility that is shown on a chart may seem chaotic or noisy. Moving averages, however, are one of the best and most widely used methods for filtering things out. MA is regarded as a useful signal and technical analysis technique in a trader’s toolkit. In volatile markets, MA is typically employed to determine the trend or momentum present. SMA is the most prevalent variety of MA (Simple Moving Average).

Copy Signal or Copy Trading

The signal provider communicates his or her trade with other traders like you in real-time while copy trading a signal. You can automatically trade in real-time the signals that the signal provider has shared if you’re utilizing a copy trading platform. Different copy trade platforms have various extra restrictions that you can utilize for security. You can, for instance, choose the signals you want to mimic and the amount of capital you’re willing to risk.

Forex Trading Signals for Free

Both paid and free forex trading signal providers are simple to find. In order to cover the cost of their services, free suppliers typically request that consumers register with one of their partner forex brokers. The paid suppliers, on the other hand, give more complex tools and services. You can use the sample account to test out their functionality as well.

Uses for Forex Trading Signals

You could initially think that using and comprehending forex trading signals is a little difficult. But the whole process gets simpler with practice. Therefore, take a moment to study the following example before applying the signals for forex trading.

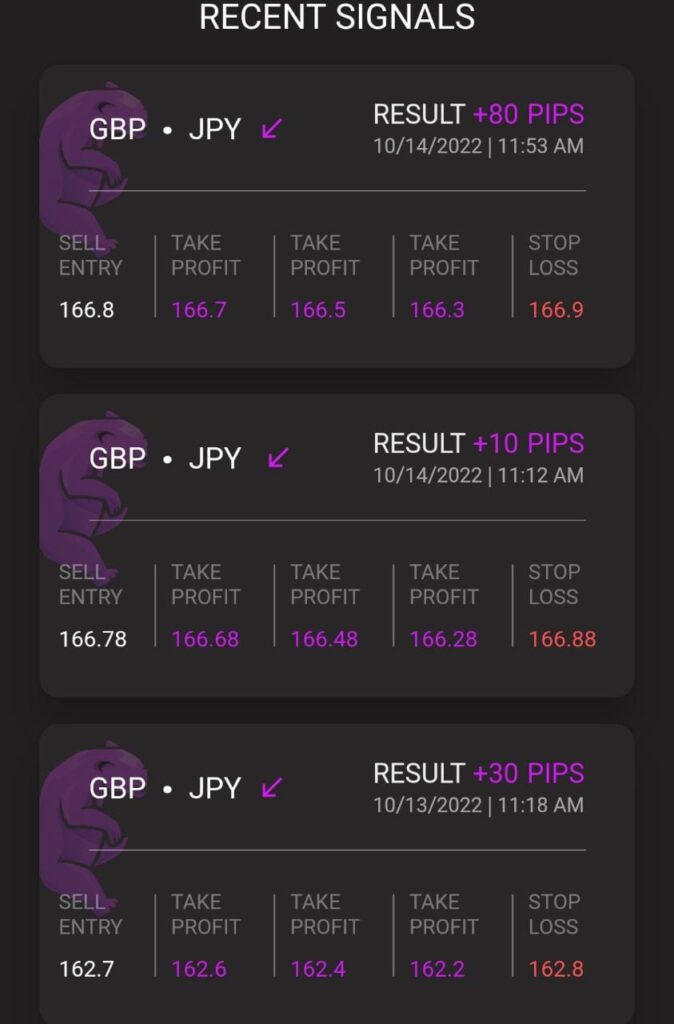

If you observe something resembling this, you can dissect the signal and discover that the signal’s call to action is to “sell” the GBP/JPY. The “CMP” is indicated at 166.8, with the predetermined “stop-loss” at 166.9 and the predetermined “take profit” level at TP1: 166.7 TP2: 166.5 Tp3: 166.4 .

Note: this GBPjpy signal was shared today at Forex buzz private signal room and all TPS hit you can check the Screenshots:

As you can see, it was initially a little intimidating to comprehend the signal’s abbreviation, but after the breakdown, it doesn’t appear that challenging.

We Just Get Signal by Forex buzz Sell US30 at CMP Now:

Here Analysis Screenshot:

Recent Comments